my personal irs odyssey - part six

"deriving their just powers from the 👉 consent 👈 of the governed"

in parts four and five we covered the “audit” for tax year 2020. part six is the continuation of the 2020 saga … with the very scary NOTICE OF DEFICIENCY.

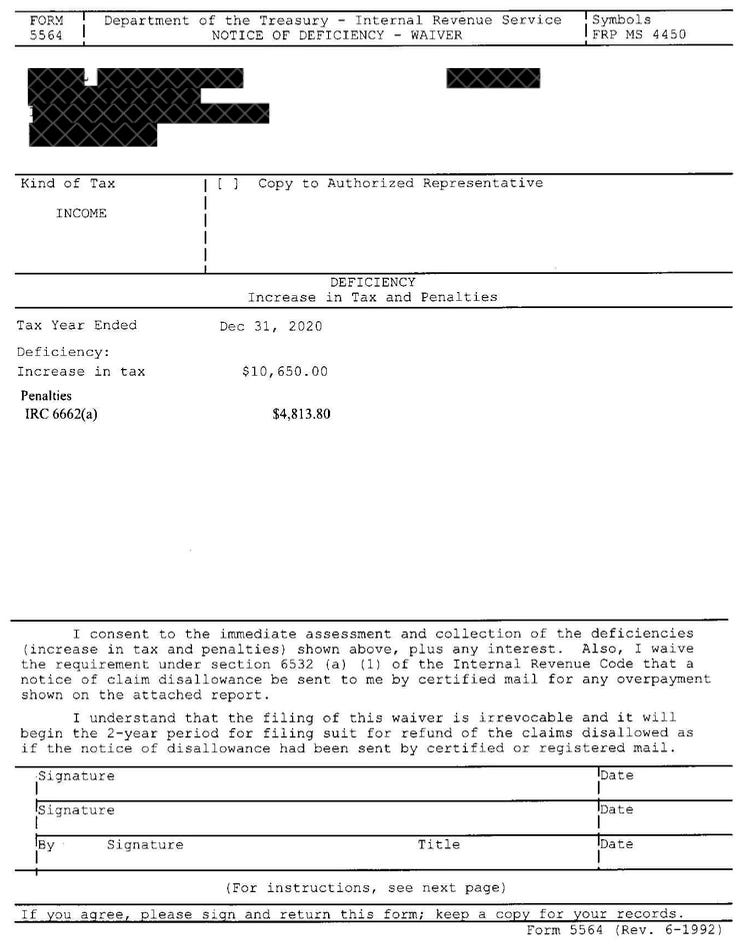

letter 3219 and form 5564:

[not shown are copies of the same forms 4549 and 886-A that were attached to the “audit” letter 525, except with the interest amount calculated at october 18 instead of august 9.]

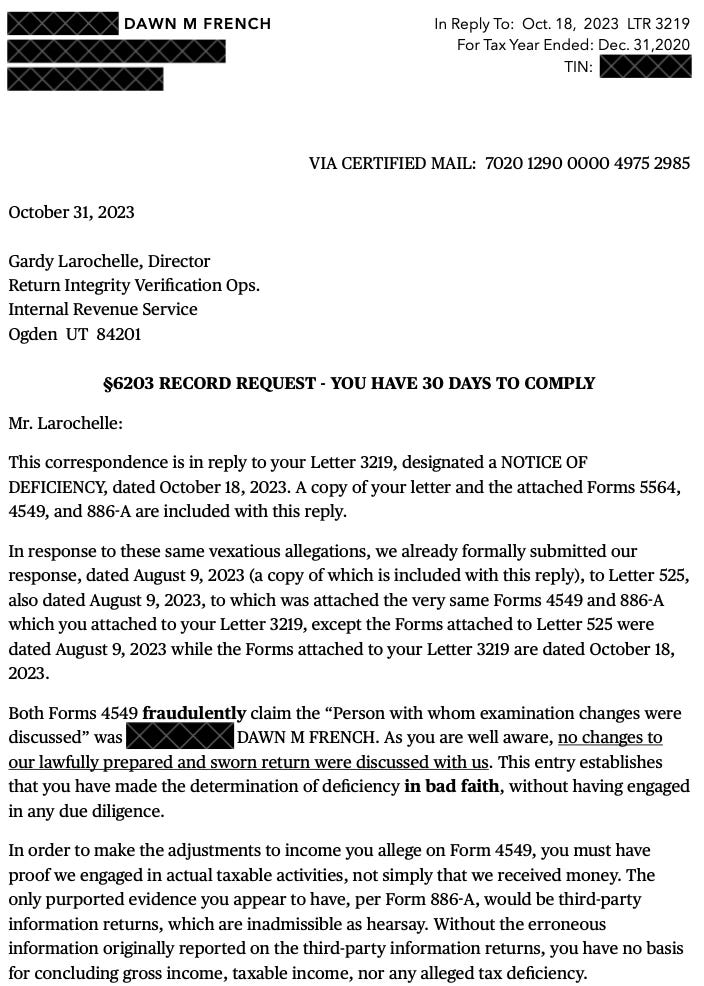

as with nearly all previous letters, notices and forms we’ve received they are issuing vague threats and begging us to consent and pay. but what they aren’t doing is responding in any way that would rebut any of our arguments.

this particular notice also suggests we “contest this determination in court” and sets a deadline to do so. but why should we have to contest this “determination” when it isn’t based on anything legitimate?

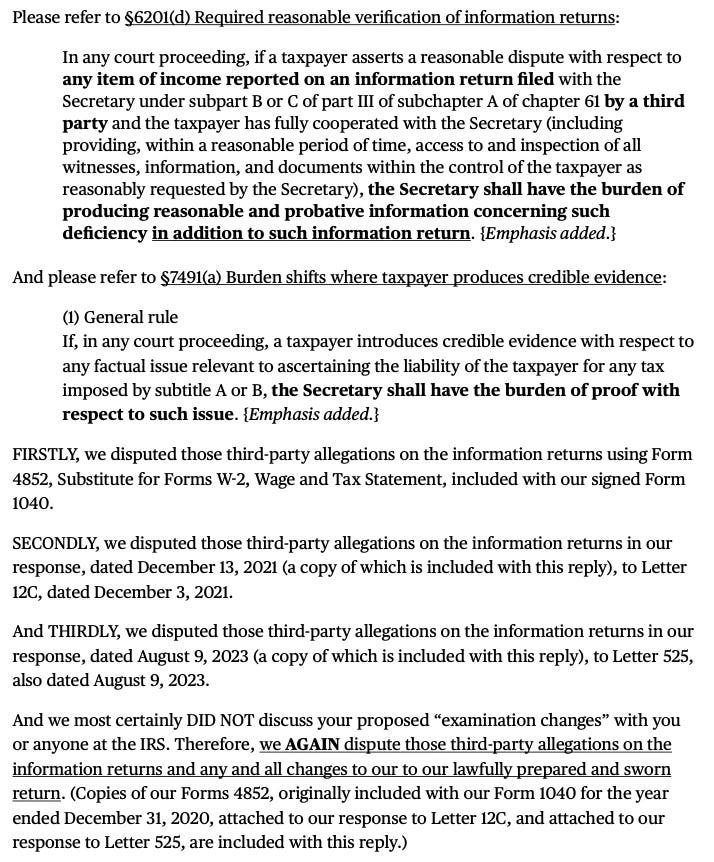

instead we shot back another lengthy reply with a demand for proof of assessment:

so we’ve caught them lying again about a supposed interaction with us (an imaginary inquiry mentioned on notice cp21b and above on form 4549). now you understand why we only respond via certified mail.

the tax court petition is referenced in the last line of our reply, but we’re not sure we’re going to file. it seems unnecessary unless they provide the requested assessment and it’s a legitimate filing. but, at this point:

the foia responses have started to come in. once we have them all we’ll share.

the only other correspondence we’ve received has been letter 2645c for both 2020 and 2022. these letters are in response to our disagreement with their attempt to “correct” our amount of reported withholding (see our reply to notice cp21b at the bottom of part four and our reply to notice cp12 at the bottom of part five).

they need another sixty days to figure out what to do after we called them on that particular bluff:

what do you think? are they bluffing? are we? are you starting to see how they need our consent? where are you still consenting to tyranny?

Good afternoon Mrs. French,

What a great time of year this is. 2023 tax season is officially over, and I have almost nothing to do except for some tax planning for clients for 2024 and helping clients get out of the trouble they've made for themselves. I have been in the interim entertaining myself reading tax law and court cases.

Of course, January will be here before we know it, and it will be back into the grind again.

Alas.

Form 4549 is the discussion. Like you, the IRS operates in writing. You can contest whatever they send you, but the notice itself is the "discussion", however one-sided you believe it to be. Those are the changes discussed with you. In the form. On the paper.

You cite Sec 6201(d), but you might want to read it a little closer - "In any court proceeding... and the taxpayer has fully cooperated with the Secretary..."

Are you in court?

Have you fully cooperated with the Secretary?

I believe the answers to those two questions are self-evident.

The IRS proves income by the W-2s provided by your employer. Your employer took deductions for the wages paid to you by reporting them on the W-2. They are not entitled to a deduction for your wages if they do not report them on form W-2. The employer will happily provide the IRS with a copy if the IRS has misplaced the copy. This is unlikely now, as they have started digitizing everything. The W-2s reported by your employer are the proof of your taxable income. The tax court, should you choose to waste more of your time and money, will find your argument without merit. Just like all the others who have beat this same dead horse before you.

"Refusal to cooperate with this request..." Heh. That's a good one. You know, the IRS can raise the penalty from $5,000 to $25,000 for each instance of frivolous tax positions. I don't know that I'd make threats that were, not only impossible for me to enforce, but inapplicable to the situation.

And you think they're bluffing? They need 60 days because the next step, if you don't go to tax court, is freezing your bank accounts, garnishing your wages, including from retirement accounts, and/or slapping liens on your property. That's if they choose to continue playing on the civil side. They can charge you criminally if they get a wild hair up their ass. And they are very slow about these things. Something to look forward to I suppose. Probably sometime in 2025 or 2026.

Let's see here, how many tax years is this? Four? There's two of you. If they decide to raise the penalty because they are annoyed with the exceedingly long and convoluted letters you keep sending them that are full of non sequiturs, empty threats and accusations of felonies they didn't commit - that's (4 x 2 x 25,000) $200,000 in penalties, plus I think the interest is up to 7%, compounded daily on the amount owed including penalties, assessed back to the point in time when the tax was due. And only dischargeable in bankruptcy if you have nothing for them to take AND the bankruptcy court decides it was all in good faith.

Well as they say...

FAFO.