i left you hanging in the middle of an audit. so we’ll wrap that up here in this post.

at the end of part four, we saw how the irs adjusted the amount i claimed was withheld, then asked me to respond if i did not agree.

a couple of interesting points:

they lied when they said, “our action is the result of your inquiry of January 25, 2022.” i made no such inquiry as my response letter makes clear.

they give no explanation for the $9,935 decrease in the amount withheld, but i can show you how they got that number and it makes absolutely no sense.

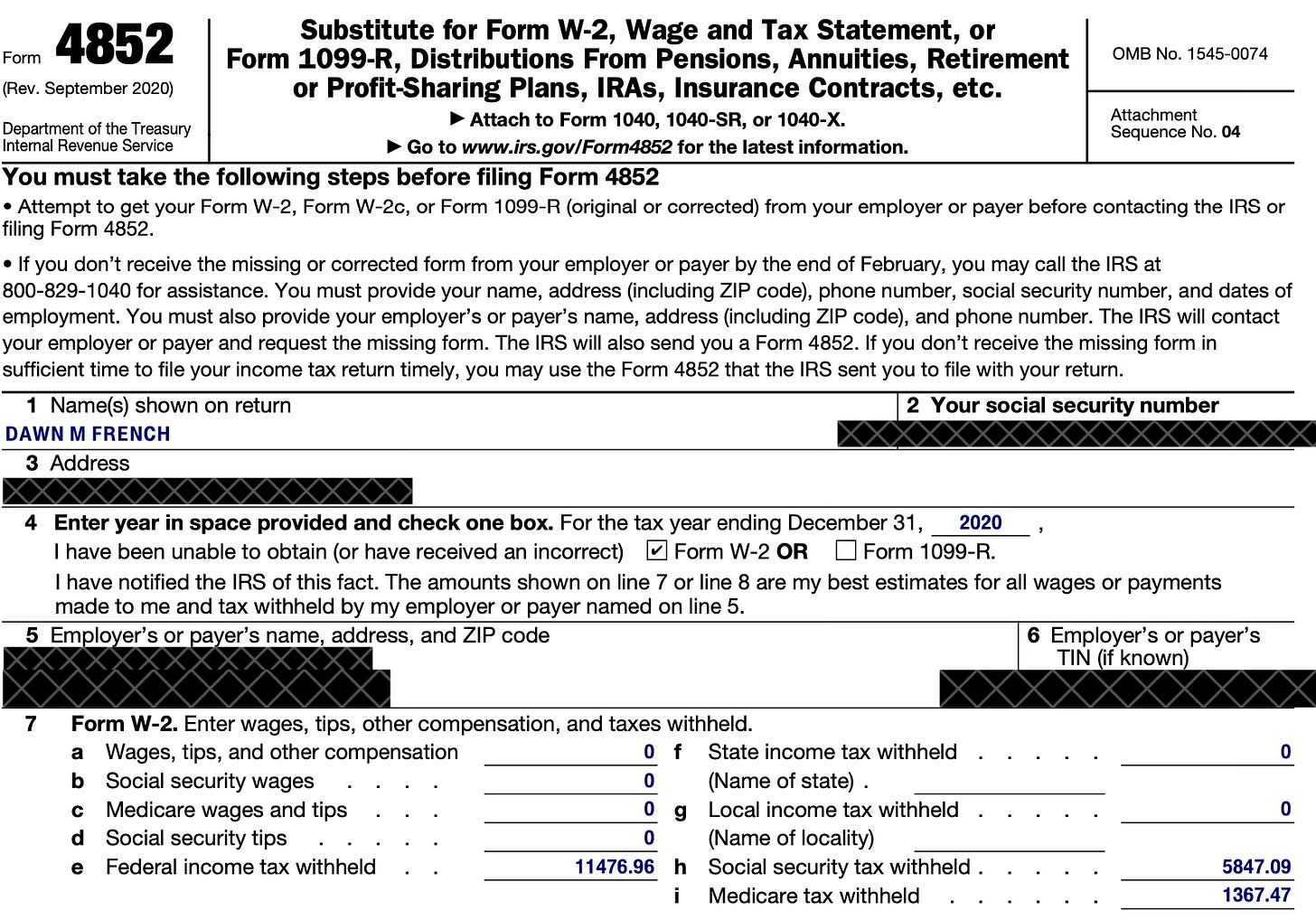

here’s the relevant portion of our 2020 return:

the $1943 was withheld from mr. french’s military retirement and the $21,411 is the sum of the federal income tax withheld, social security tax withheld, and medicare tax withheld shown on four forms w-2, and reported on the forms 4852 that i filed, for me and my kids.

the difference between the $21,411 i reported and the $9935 adjustment proposed by the irs is $11,476. that number is exactly the amount of federal income tax withheld from me only.

apparently, they claim the amounts of federal income tax withheld for my kids and the social security tax withheld and medicare tax withheld for all three of us wasn’t actually withheld. then they lied and said they made that change because of an imaginary “inquiry” i made.

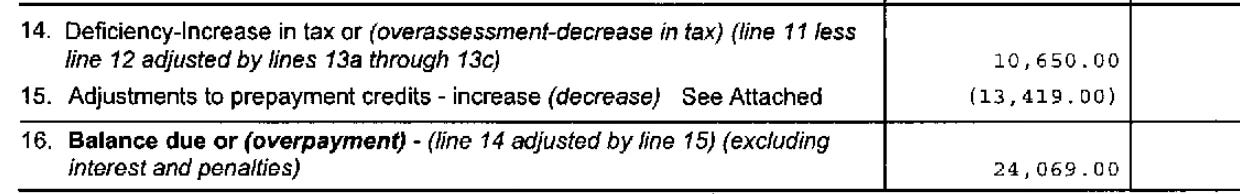

now that we’ve investigated where the three primary amounts shown on form 4549 come from, let’s take a brief look at the two remaining amounts: the accuracy charge and the interest amount.

the accuracy-related penalty is 20% of a total underpayment of $24,069. but where did that number come from? it’s the result of a dumb math error. not only are these liars engaging in fraud, but they don’t know how to subtract a negative number. let me show you:

they claim the $10,650 is the total corrected tax liability - what they claim i owe for tax year 2020 after incorporating the erroneous “wages” and “taxable interest” reported to them.

the $13,419 is the amount they agree as withheld and is still owed back to me.

anyone with a basic understanding of subtraction would know that if i owe you $11 but you still have $13 you owe me, you wouldn’t add them together and claim i owed you $24. but that’s exactly what they did.

so the correct accuracy-related penalty is 20% of -$2769 or $0. and that’s assuming they can prove i was negligent, because due process matters in a truly free society.

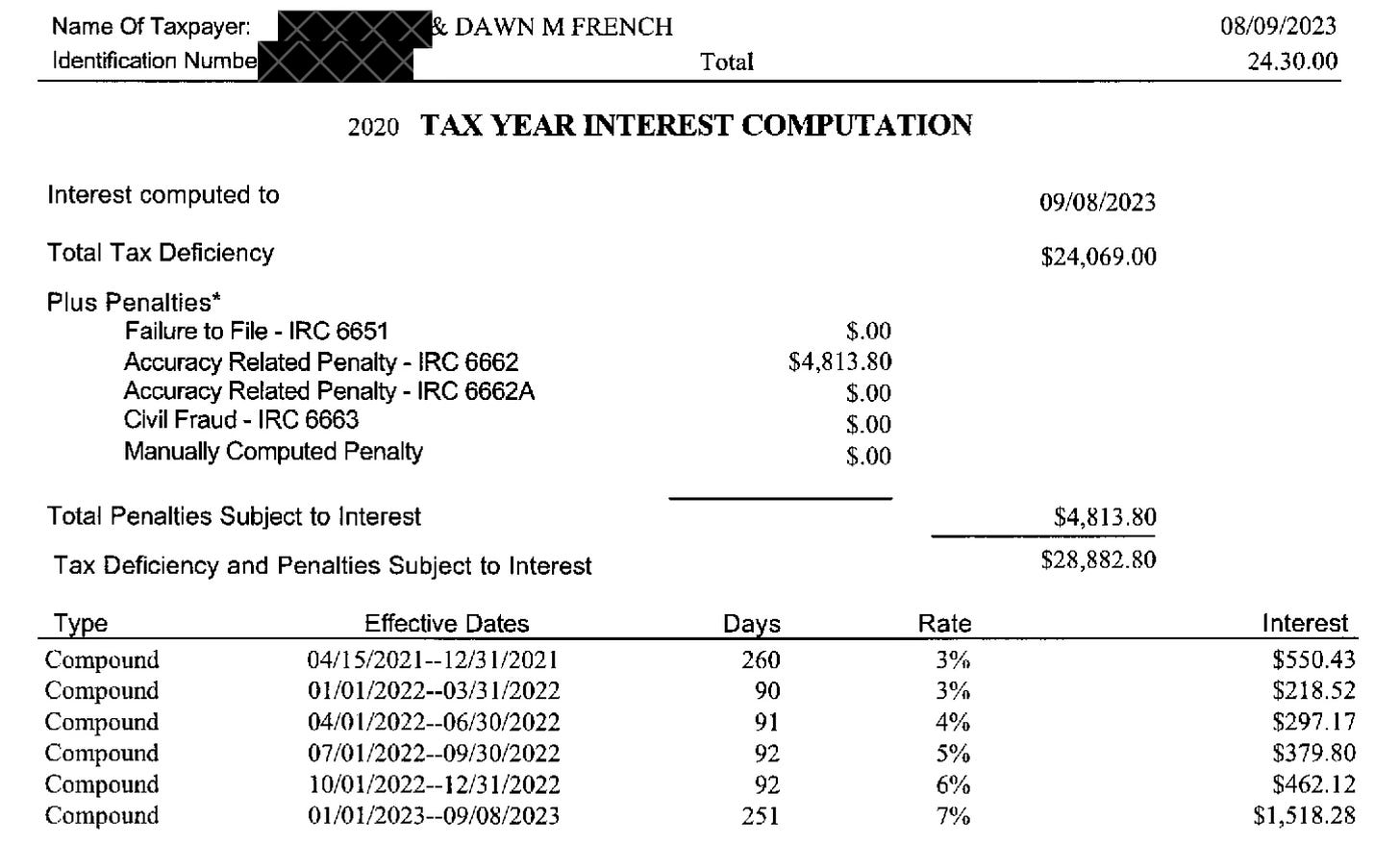

for now, let’s move on to the last piece, the interest penalty. and as you can probably guess, it should be $0 as well.

we’ve already seen how the total tax deficiency shown is the dumb-math-error number of $24,069, which should really be -$2769. and i’ve already shown you that the $4813.80 accuracy penalty should be $0. so the total deficiency and penalties subject to interest should also be zero. ($0 + $0 = $0) so no interest is due.

i’m assuming they are trying to scare me with that final number of $32,309, but we already covered that i don’t scare easily. and i’m surely not frightened of criminals who can’t add.

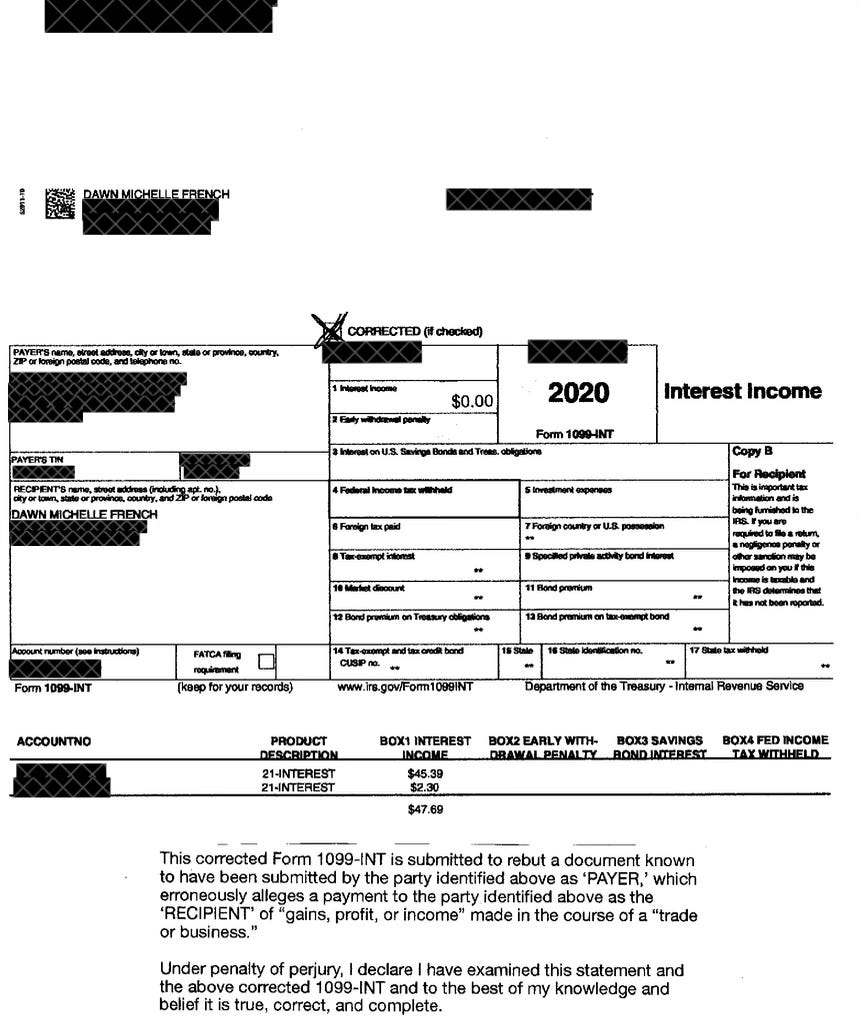

i’ll post our reply below, but first i had to dig up whatever 1099-int i could find so that i could rebut it and because form 4852 is only for correcting forms w-2 and 1099-r, here’s what I submitted (not shown, but signed and dated):

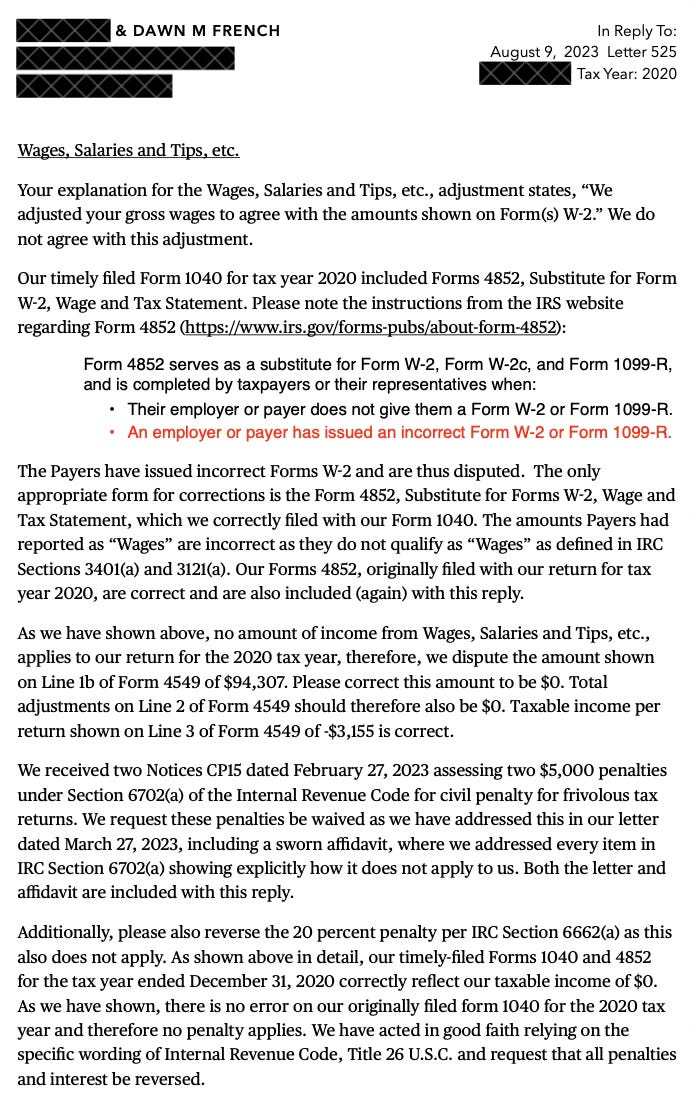

and here’s our response to letter 525:

you might have noticed there is no certified mail number on this response. that’s because letter 525 included a cover sheet with a barcode to upload it directly to the irs:

and we haven’t received anything else regarding tax year 2020 and our reply above was sent in august of 2023.

as mentioned in part three, we’ve submitted foia requests for our official records so that we may include any relevant information in our lawsuit.

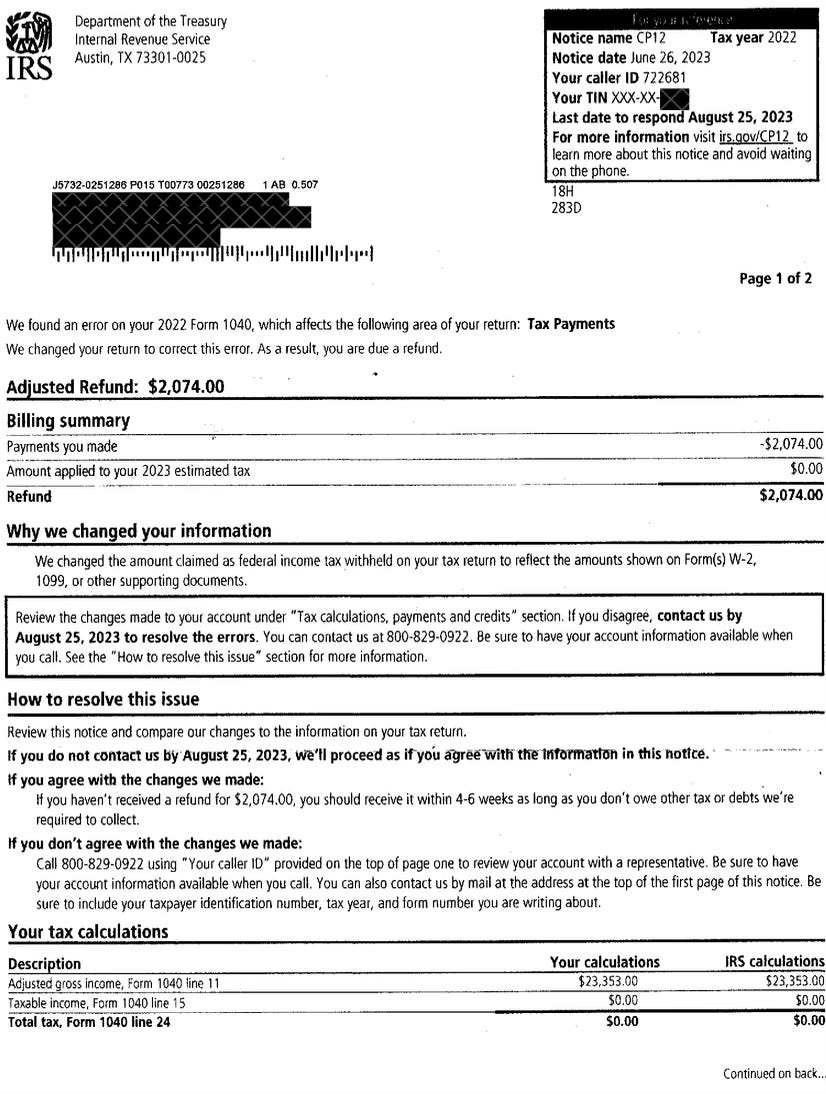

the last item we haven’t yet covered is the notice cp12 for tax year 2022:

this is similar to what we saw in notice cp21b for tax year 2020, where the irs changed the amount i reported as withheld, only this time they decided to ignore the sum of the federal income tax withheld, social security tax withheld, and medicare tax withheld from me and the two kids entirely.

at least they didn’t lie and say they made the change because of an imaginary “inquiry” i made. instead they claim they found an “error.”

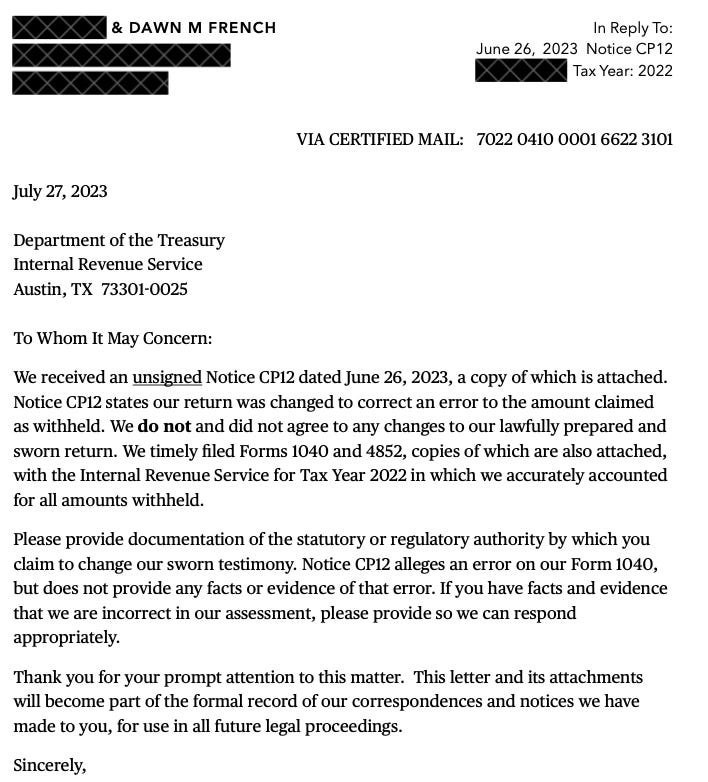

and of course, we do not agree with their “correction” and responded accordingly:

so that’s everything we’ve received and replied to so far. we’re now just waiting to hear back on all four tax year’s worth of foias. once we have that information, or if anything else comes in, i’ll continue this series.

i learned so much from this process and i continue to learn more every day. i hope you’ve found this helpful.

Thanks for the insight. And I respect you for having the balls to stand up to the crooked feds. I hope it works out. I’ll be following with interest

You told me in our original conversation on this topic over at the bad cat, that tax preparers rely on software so none of us know anything. I just wanted to let you know that is indeed the case for many tax preparers, I will agree with you on that point, however, I am not your ordinary tax preparer. I'm TheeAccountant, and I wrote my own excel spreadsheet to reconcile tax returns to my workpapers when I was working with some cheap software that sucked. I know how all the numbers flow on forms 1040, 1041, 1065, 1120s, and 1120, and your calculation above is incorrect.

The $21,411 would have been only federal income tax withheld on the W-2. Social security and Medicare do not show up anywhere on the form 1040. They are used in other calculations on other schedules but are not part of that line. You paid in $23,354 in federal income tax and you owed $10,650, which makes for a refund of $12,704 - with two years of interest on that amount that should be the $13,419. So, the $13,419 looks to be the amount you over-paid in 2020, including interest.

As to why it's negative, it's a reduction in the credit to your account and it's getting added back to what is owed because it's frozen (they're holding it because you've been hit with penalties). If it was a positive number there, it would have reduced the amount held. So, you would have gotten a refund, with interest no less, if you'd filed an accurate return. You will never see that money now. Me personally, I can think of better things to do with my money than to give it to the government unnecessarily. Which is what has happened here. Whenever my clients pay penalties because they didn't make the quarterly payments that I told them to make, it hurts my heart. Why are you giving more money you didn't have to give to the federal government??

Also, in one of the other posts, you said they "stole" from your 2021 over-payment to pay the penalties they applied in 2020. Yes, they do that because you are accruing interest every day on those penalties, so applying the over-payment stops the interest accruing. Nice of them, eh?

You know, if you're going to try these shenanigans, which I strongly advise against [like please, PLEASE, don't do this], I'd at least make sure that you hadn't over-paid and were due a five-figure refund for multiple years. What a very expensive lesson.

At any rate, this has been an interesting exercise much in the vein of Don Quixote. I do seriously appreciate you posting all of these notices. I've never seen these some of these before.