but what about bob? - part two, where we learn about schrödinger's duck taxes, or whatever

tales from tax court - episode eight

imma beat that dead horse again.

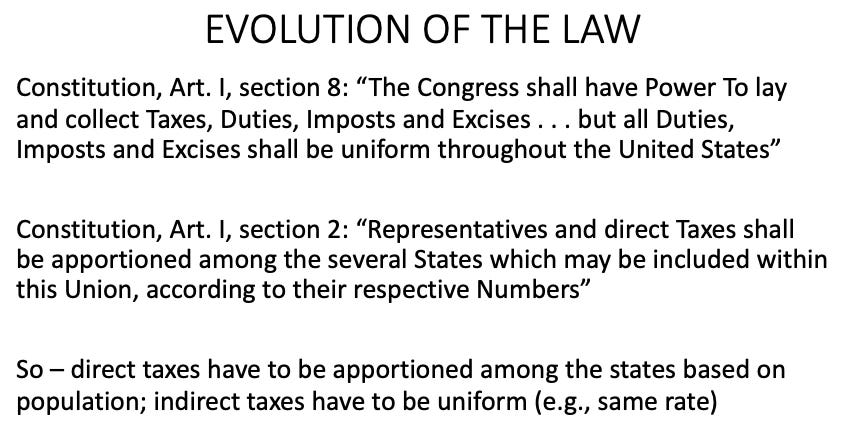

there are two, and only two, categories of constitutional taxes—direct, and not direct

by their designations, it should be abundantly clear that these two categories are separate, distinct, and mutually exclusive.

for example, we have a pond here and if we were to categorize the types of creatures that utilize our pond as ducks and not ducks, you would know that there are no creatures in existence that are in both of those categories, and no creatures that are not in either of those categories.

it’s the same for taxes.

the schrödinger's cat paradox, is a

thought experiment, [where] a hypothetical cat in a closed box may be considered to be simultaneously both alive and dead while it is unobserved, as a result of its fate being linked to a random subatomic event that may or may not occur

so the cat in the box is both dead and alive, or, to use our pond analogy above, we have here a creature that is both a duck and not a duck. that’s why it’s a paradox.

obviously, a creature cannot be both a duck and not a duck, just like a cat in a box cannot be both dead and alive, just because we can’t see it. and further, a tax cannot be both direct and not direct.

[aside—that cat paradox, illogical and stupid as it is, is now “part of the foundation of quantum mechanics,” according to wikipedia, which should concern you about the state of mainstream physics. only grifters will sell you a paradox as physical reality, which is what physics is supposed to be. if you want to understand what’s really going with superposition, read this and this.]

but, what about bob? yep, he tries to convince me income taxes are a paradox. both a direct tax and an indirect tax at the same time. both dead and alive. both a duck and not a duck. what a maroon.

if you’ll recall from part one, i sent slides to bob before our meeting and he presented slides during our meeting and then emailed them to me afterward.

here are the relevant slides

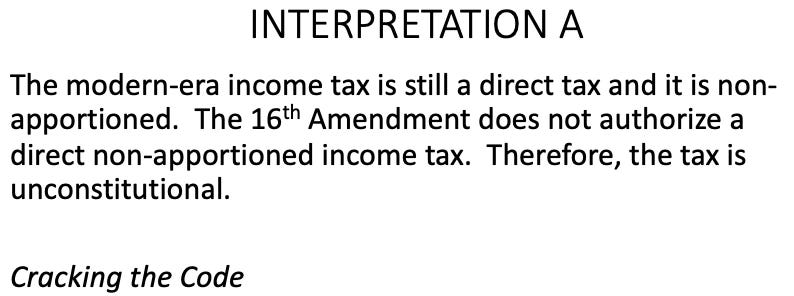

interpretation a:

misdirection to slide in a lie. cracking the code does state that the 16th amendment did not authorize a direct non-apportioned income tax, and so did the supreme court, which i’ve covered repeatedly, and in detail [see here and all previous ‘tales from tax court’ episodes].

however, no where does hendrickson state that the modern income tax is a non-apportioned direct tax. and of course, it is not.

interpretation b:

flat-out lie. we reviewed the brushaber case in detail here, and we covered the errors in parker here and here.

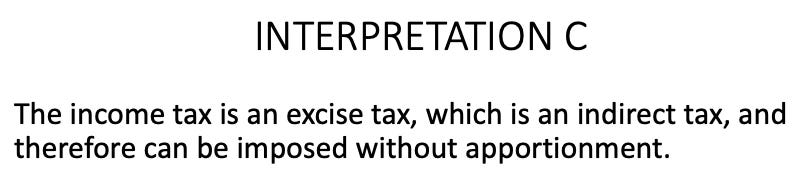

interpretation c:

technically true, but not completely honest. we saw several places where the supreme court specifically referred to the income tax as an excise, and brushaber was one of them

taxation on income [i]s in its nature an excise entitled to be enforced as such

but notice that bob doesn’t acknowledge this. i had also showed where the income tax is referred to as an excise in the congressional record

interpretation d:

more misdirection and lies. he claims that brushaber is a source for his claim that the income tax is not an excise, despite the quote above. but he’s splitting hairs here.

excise or not an excise is word play.

we no longer refer to the income tax as an excise explicitly, even though it had repeatedly been called an excise previously.

this was so you do not question the reality that income is not everything that comes in.

excises are taxes only on “certain activities and privileges” and if you associate income taxes with excise taxes then you will understand the truth of the matter. the feds can’t have that.

comparison:

and here’s where the expert grifter sells you on the impossibility that the income tax is both a direct tax and not a direct tax.

of course i called him on it:

bob’s provably false statements:

cracking the code claims the income tax is a non-apportioned direct tax

the income tax is a direct tax and the 16th amendment simply removed the apportionment requirement from only income taxes and not other direct taxes, per brushaber

the income tax is both a non-apportioned direct tax and an indirect tax—that is simultaneously an excise but not really an excise

this post is getting a bit long so let’s wrap up here.

how are you feeling about this eminent legal scholar? what is your confidence level in the knowledge and understanding of the law school faculty, given the students are paying upwards of $50k per year? let me know your thoughts.

Quantum nonsense is my pet peeve, and with solid theoretical physics training from Stanford University, I am qualified to rant about it.

I am amazed that I've never seen anyone point out that THE CAT has MEASURED the wave function and "knows" whether it is alive or dead. (Unless you want to debate whether it is "conscious enough" to "collapse" the wave function. Have fun with that...) So there really is no paradox.

Put an inanimate object in there, instead of the cat, and the problem goes away, because no one "knows" the answer until someone looks. Coins in a closed box don't care whether they are heads or tails.

My professors did not find the cat paradox especially profound, and the term "consciousness" never came up in a full year of quantum mechanics courses. Their attitude was simply that the math works and we don't know why, and the cat paradox is simply one of many signs that we don't. Lay culture makes way too much of this and pays way too much attention to the few qualified personalities who want to talk woo about it (and the hordes of unqualified).