but what about bob? - part one, where we get to meet the tax expert

tales from tax court - episode seven

at the hearing for the irs’ motion for summary judgment against us, the judge offered to delay ruling on their motion, and our response, until we had to opportunity to meet with a lawyer with the low-income tax clinic out of one of the law schools in the area (dfw).

[we had requested help from a low-income tax clinic out of a different law school in the area, but those lawyers declined as there wasn’t enough time to prepare for our hearing date.]

the clerk gave us the number and during recess we called the lawyer and set the intention to follow up to discuss our case. he offered his services for free.

we were grateful to have an expert give his opinion (for free!) on our arguments and to show us where we had gone wrong in our reasoning.

spoiler alert: you get what you pay for.

meet bob

we asked bob to send us some information specific to the tax clinic he is the director of. here’s what he provided:

You can find additional – although somewhat limited – information about our clinic at the law school’s “Legal Help” page here: https://www.law.tamu.edu/legal-help.html This includes all of our clinics, but there is a tab for the Tax Dispute Resolution Clinic specifically.

Some general information about “low-income taxpayer clinics”, which are funded in part by grants from the Taxpayer Advocate Service, is available here: https://www.irs.gov/advocate/low-income-taxpayer-clinics and here: https://www.irs.gov/pub/irs-pdf/p5066.pdf

after our very brief meeting over the phone, while on recess from our hearing, we connected via email and worked to schedule a meeting over zoom.

he referred to our meeting as a “preliminary consultation” and that we would not be charged. after our zoom meeting, he offered to answer my questions via email, but declined to participate in a follow-up zoom call.

and we had a lot of questions. so bob and i exchanged a lot of emails. over the next four months.

it’s unfortunate that we immediately started out on the wrong foot, as he provided during our zoom meeting “information” that was absurd and cannot possibly be true.

to be more efficient, i sent a preparatory email and a slide deck for discussion ahead of our call:

Mr. Probasco,

I really appreciate that you agreed to meet with me to discuss our tax court case. And so that I don’t waste your time I will get right to the point.

First, I have a communication disability that at times prevents me from engaging effectively in verbal exchanges. This is especially the case when there is anxiety, as when I am being threatened with a significant fine just for saying the “wrong” thing. I find it much easier to organize my thoughts in writing or some other visual form (slides). Hence this preparatory email and attachments.

Second, I genuinely want to get clarity here. There seems to be something blocking me from achieving a precise understanding of what exactly I said that was “frivolous.”

As I show in the attachments, I rely on and agree with what the Supreme Court says about the nature of the income tax. And with no hint of irony, the IRS and the tax court deem the Supreme Court as frivolous if it deems me so for agreeing with them. Utterly ridiculous.

As I also show, the “authorities” and “relevant case law” upon which the IRS and tax court rely to make their case that what I have said is frivolous, are erroneous! [see this post for the details] The cases the IRS cites simply state the exact opposite of what the Supreme Court says, and anyone who disagrees is frivolous. That’s just dumb.

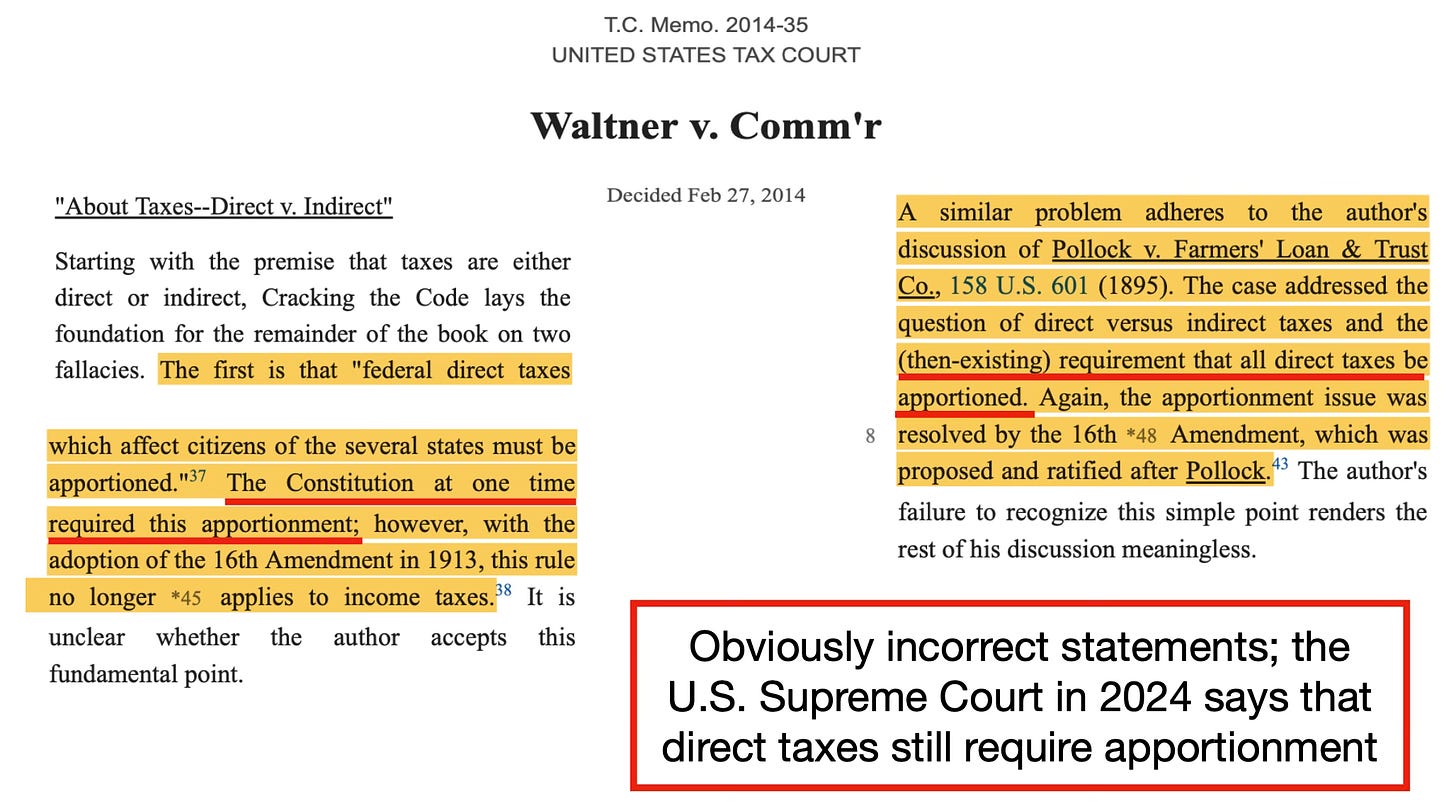

I mean really, just compare the Moore decision with Waltner v. Comm’r or Parker v. CIR.

And then look me straight in the eye and tell me there “is no contradiction” (what the Tax Court Judge literally told me). I was struck almost silent by the sheer idiocy.

And of course the IRS risks NOTHING for being wrong while we are on the hook for MORE THAN AN ENTIRE YEAR’S WORTH OF [hub’s] PENSION.

The financial threats and aggressive behavior? That is called “bullying” and it should not be exhibited by someone in that position, especially against someone with autism who specifically requested an accommodation per the Americans with Disabilities Act.

If you decide not to engage with us, we would really appreciate if you could refer us to someone whom you think might be able to help.

Thank you for your time and consideration.

<slides for discussion.pdf>

i won’t reproduce the whole slide deck here, but it was screen shots of quotes from court cases that i’ve shared here before, with highlighting/underlining and comments added. here’s a sample:

oh, and memes. i added memes to my slide deck.

‘cause, who doesn’t love memes?

for this series in ‘tales from tax court,’ i’ll be going through the tedious process of detailing and tallying the many times the “expert” contradicts himself, declares things that cannot be verified, and states things that are verifiably false.

i hope you’ll stick around.

Get a copy of Fruit From a Poisonous Tree for a complete understanding of the Constructive Fraud that has been foisted on the American people since before the Federal Reserve act.

From Fruit From a Poisonous Tree by Melvin Stamper:

Edward Mandell House had this to say in a private meeting with Woodrow Wilson (President, 1913-1921) From the private papers of Woodrow Wilson:

“[Very] soon, every American will be required to register their biological property in a National system designed to keep track of the people and that will operate under the ancient system of pledging. By such methodology, we can compel people to submit to our agenda, which will affect our security as a charge back for our fiat paper currency. Every American will be forced to register or suffer not being able to work and earn a living. They will be our Chattel and we will hold the security interest over them forever, by operation of the law merchant under the scheme of secured transactions. Americans, by unknowingly or unwittingly delivering the bills of lading to us will be rendered bankrupt and insolvent, forever to remain economic slaves through taxation, secured by their pledges. They will be stripped of their rights and given a commercial value designed to make us a profit and they will be none the wiser, for not one man in a million could ever figure our plans and, if by accident one or two would figure it out, we have in our arsenal plausible deniability. After all, this is the only logical way to fund government, by floating liens and debt to the registrants in the form of benefits and privileges. This will inevitably reap to us huge profits beyond our wildest expectations and leave every American a contributor or to this fraud which we will call “Social Insurance.” Without realizing it, every American will insure us for any loss we may incur and in this manner; every American will unknowingly be our servant, however begrudgingly. The people will become helpless and without any hope for their redemption and, we will employ the high office of the President of our dummy corporation to foment this plot against America.” ….

Get a PDF and READ THE BOOK here: Fruit From a Poisonous Tree https://archive.org/details/fruit-from-a-poisonous-tree/mode/2up