if you’ve been keeping up with the comments in some of my other posts, you’ll see how woefully misinformed your average licensed cpa is. they don’t know the code because they don’t know how to read it. they think they know because they have other documents they read like memos, notices and white-papers, and they know how to operate their accounting software, but otherwise they are clueless.

there doesn’t seem to be any awareness that the supplemental information they are operating from is NOT the law, and the law is what matters, nor any awareness that their supplemental information has also been “spun” for the purpose of concealing and continuing the fraud as it’s in the best interest of those perpetuating the fraud that you and your tax ‘professional’ remain ignorant of the limited scope of the tax. the ‘professionals’ operate from incomplete/incorrect information and never confirm their understanding by actually reading the code.

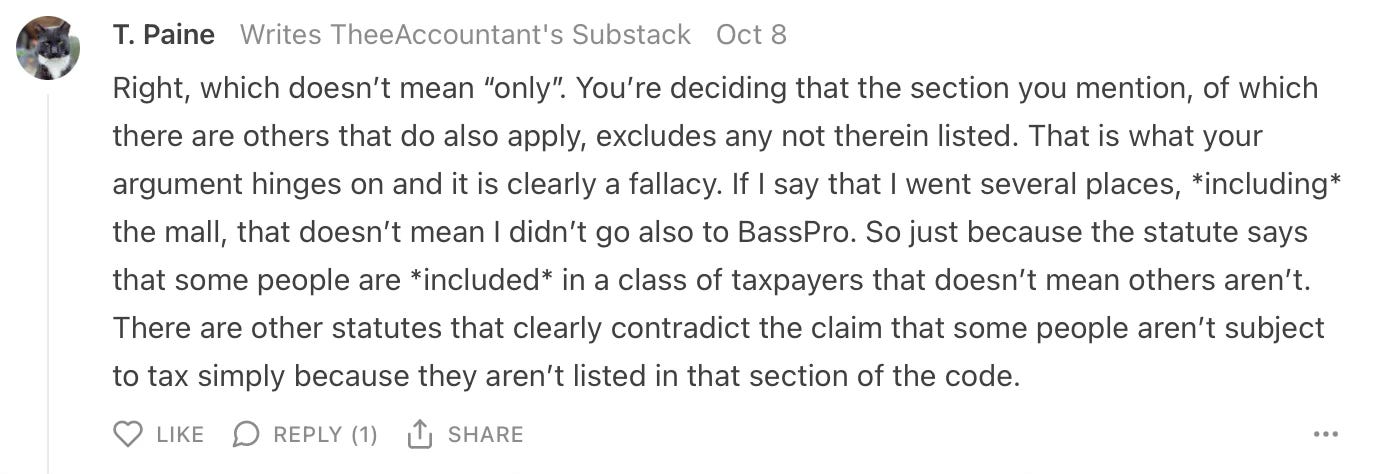

i had to learn this the hard way about the cpa to whom i paid my hard-earned money. i had hopes that this one would be able to intelligently defend their position, but then we see this:

here’s the link to that lengthy reply.

my lengthy response is pasted below:

Okay, that specific reference doesn't exactly settle the issue because ultimately, they state, "Thus, it is not only far more natural, but also better comports with § 7701(c), to construe § 7343 as building upon, and not overriding, the more general and broadly applicable definition of "person" found at § 7701(a)(1)."

What they did not say is that "person" includes the common usage of the word or anything not already in the definition in Section 7701. So, it is still limited to what is expressly stated in the title.

Remember, we are dealing with the application of the law, so if terms with definitions are provided there is no precedent for assuming those terms mean the same as the commonly used word, otherwise, there would be no need to define them.

But let's take a closer look at the definition of "includes" in the code itself, because it's important we understand exactly how it applies to the code.

§7701. Definitions

(c) Includes and including

“The terms "includes" and "including" when used in a definition contained in this title shall not be deemed to exclude other things otherwise within the meaning of the term defined.”

That is LIMITING. What it does not say is, "shall not be deemed to exclude other things otherwise within the meaning of the common usage of the word."

It says, "within the MEANING of the TERM DEFINED." That is specific. The terms are explicitly defined, and the word "includes" means that other similar things to the explicit definition, while not stated, are not excluded.

Here's more precedent, which is very important in the application of the law, in favor of that understanding:

- 27 CFR § 18.11 - Meaning of terms.

"When used in this part and in forms prescribed under this part, where not otherwise distinctly expressed or manifestly incompatible with the intent thereof, terms shall have the meaning ascribed in this section [terms - this is key - shall have the meaning ascribed in THIS SECTION. these are very specific location instructions so that the law can be applied as precisely as possible]. Words in the plural form shall include the singular, and vice versa, and words importing the masculine gender shall include the feminine. The terms “includes” and “including” do not exclude things not enumerated which are in the same general class [similar to 7701(c) above but with 'same general class' qualifier instead of 'otherwise within the meaning of the term defined']."

here's another:

- 27 CFR § 447.11 - Meaning of terms.

"When used in this part [specific location] and in forms prescribed under this part [specific forms], where not otherwise distinctly expressed or manifestly incompatible with the intent thereof [we saw that exact phrase at 7701(a)], terms shall have the meanings ascribed in this section [same instructions as above]. Words in the plural form shall include the singular, and vice versa, and words imparting the masculine gender shall include the feminine. The terms “includes” and “including” do not exclude other things not enumerated which are in the same general class or are otherwise within the scope thereof." [shown here with the 'same general class' and 'within the scope thereof' qualifiers.]

So, look, I can do this all day. I've shown you a couple of court rulings and a couple of code references. I can go more, you tell me how many you need before you see a pattern.

I get it, legalese is difficult to parse. But I have a couple of decades of practice.

For you to claim that terms mean the same as the commonly used words is very naive. Even your example above proved my point.

Can you just imagine how incredibly chaotic it would be to even attempt to administer the vast library of laws and regulations without a very high attention to detail?

and the comment regarding my argument hinging on the meaning of “includes” is not correct. my argument hinges on the correct interpretation of the law and the 16th amendment. the argument over the meaning of the term “includes” is a distraction because it’s already a well-settled legal concept:

The Lawful Use of “Includes” and “Including” Revisited…

the terms “includes” and “including” are able to be “enlarged” only in certain specific ways, and those ways require that the definition be read only as being “enlarging” so as to encompass those things that fit naturally within the same specific class of persons, objects, locations, or legal entities actually listed in the original “includes” or “including” declaration

this basically means that all of the items following “includes” or “including” must have an identifiable and natural class relationship in order to be considered a viable addition to the “enlargement” intent and functionality of the statute

well, i think it’s well-settled but i’ve been marinating in this stuff for years, so please let me know what you think is still unclear here.

it’s a sad state of affairs that the experts are the last people you should be trusting with your health or your wealth.

You act like you’ve done something clever but it appears from what you’ve posted that you’ve paid all your taxes. Let me know when you get a refund of all that money you gave to the federal government, along with the $40,000+ in penalties and interest included ($5,000 penalty x 2 MFJ x 4 years, that it looks like they haven’t gotten around to assessing fully) and that they garnished from the refunds they held.

🥱