because the attorneys for the irs and the tax court judge like to pretend that they do not know the basics of tax law in this country [you might argue that these low level apparatchiks are just as propagandized as the rest of us, but it’s more likely the case that their paychecks prevent them from being truthful] …

and also because we were accused of claiming that income taxes are not constitutional and that “income” is not taxable (in the government’s motion for summary judgment against us, which we’ll hit later in this series) …

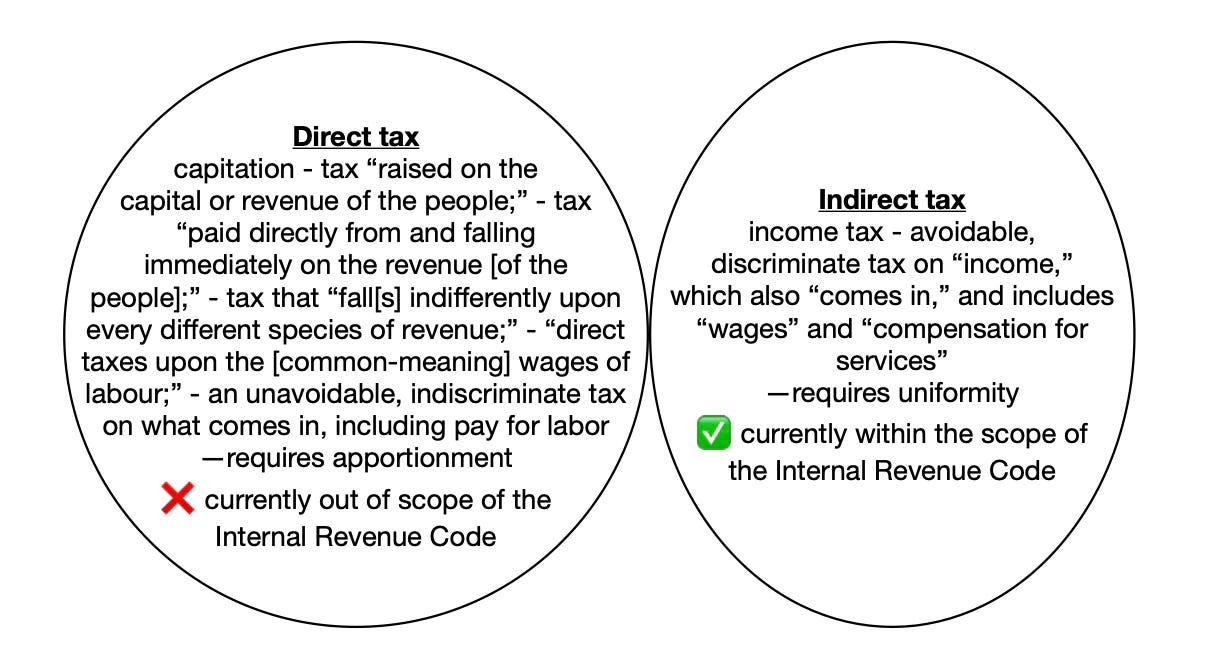

i continue to beat that dead horse with respect to the fundamental differences between direct and not-direct taxes

See Moore v. United States, 602 U.S. ___ (2024)

Because income taxes are indirect taxes, they are permitted under Article I, §8 without apportionment. … In 1861, Congress enacted the Nation’s first unapportioned income tax. 12Stat. 309. The Civil War income tax was recognized as an indirect tax “under the head of excises, duties and imposts.” Brushaber, 240 U. S., at 15; see also Springer v. United States, 102 U.S. 586, 598, 602 (1881), …

and

… this Court has held that the tax remains a tax on income—and thus an indirect tax that need not be apportioned.

See Brushaber v. Union Pacific R. Co., 240 U.S. 1 (1916)

Moreover in addition the conclusion reached in the Pollock Case did not in any degree involve holding that income taxes generically and necessarily came within the class of direct taxes on property, but on the contrary recognized the fact that taxation on income was in its nature an excise entitled to be enforced as such [the U.S. Supreme Court states the income tax is inherently excise-like and should be enforced or administered similarly] …

See 26 USC 61(a) Gross income defined, General definition

Except as otherwise provided in this subtitle, gross income means all income from whatever source derived, including (but not limited to) the following items: (1) Compensation for services, including fees, commissions, fringe benefits, and similar items …

See 26 USC 3401(a) Definitions, Wages

For purposes of this chapter, the term "wages" means all remuneration (other than fees paid to a public official) for services performed by an employee for his employer, including the cash value of all remuneration (including benefits) paid in any medium other than cash; except that such term shall not include remuneration paid…

See 26 USC 3121(a) Definitions, Wages

For purposes of this chapter, the term "wages" means all remuneration for employment, including the cash value of all remuneration (including benefits) paid in any medium other than cash; except that such term shall not include…

See Moore v. United States, 602 U.S. ___ (2024)

Indirect taxes, on the other hand, include “Duties, Imposts and Excises.” Art. I, §8, cl. 1. These were taxes that people could avoid by adjusting their behavior—generally, taxes on articles of consumption. See The Federalist No. 21, p. 116 (E. Scott ed. 1898) (A. Hamilton). “Indirect taxes” are not identified by that name in the Constitution. But, the Constitution’s delineation of a direct-tax category signals the existence of a complementary indirect-tax category.

See Moore v. United States, 602 U.S. ___ (2024)

…the parties have cited no apportioned direct taxes in the current Internal Revenue Code, and it appears that Congress has not enacted an apportioned tax since the Civil War. See 12 Stat. 297; E. Jensen, The Taxing Power: A Reference Guide to the United States Constitution 89 (2005).

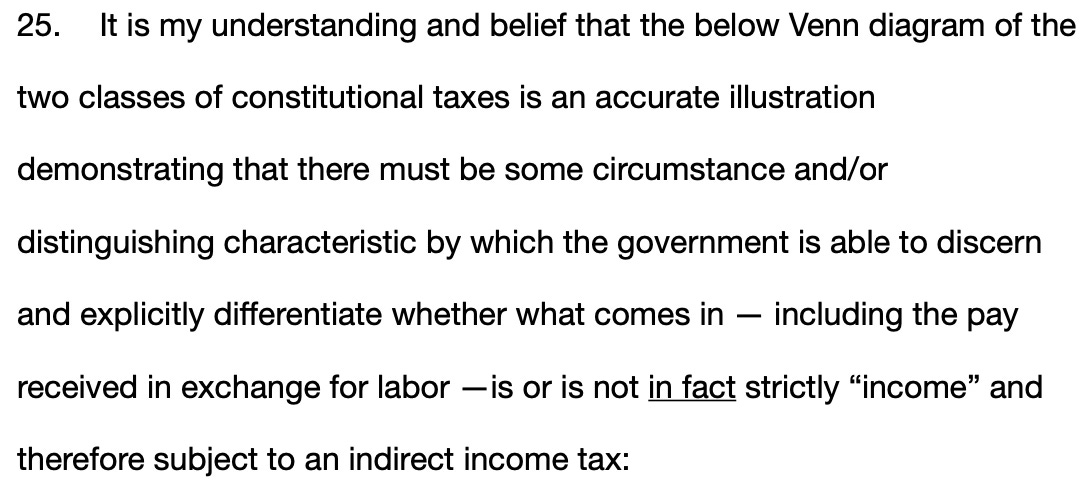

yes, i put that venn diagram directly in my filing.

because repeatedly restating my thesis — that there must be a distinguishing, objective characteristic by which the government, and the rest of us, can determine whether the pay we receive for the work we do is in fact “income” — is not enough to get through to these people.

i’m hoping the above is enough for you to see it.

do not mistake me: if you do, in fact, have “income” you should definitely pay your taxes, which you do owe. and in no way am i suggesting otherwise.

but can you clearly articulate how you know that what you received is in fact, “income?”

and it cannot be solely because it “came in.”